Navigating the new obligations for employers triggered by the EU Posted Worker Rules.

Find the extensive Q&A report at the end of this article.

(…)

(…)

Who Is A Posted Worker?

“A person who, for a limited period of time, carries out his or her work in the territory of an EU Member State (= EU or EEA Member State or Switzerland) other than the state in which he or she normally works.”

-

- Posting under a contract of services (generally: work at a client site)

- Posting within same corporate group

- Hiring out of a worker by temporary employment agency to a user undertaking

Note:

-

- Employee is on a temporary assignment – not local contract

- Nationality not relevant

EU Posted Workers: Extra Scope Considerations

General rule: Applies within the EU, EEA and Switzerland.

In some countries based on National Legislation, included are:

-

- Postings originating from outside of EU/EEA/Switzerland

- Self-employed workers

Three Considerations Applicable to Posted Worker

-

- Labour Law (Employment Protection)

- Social Security Law (A1 (COC))

- Immigration Law (Local/EU Registration (Work/Residence Permits)

Legislation History

-

-

Initial Directive – 1996

Fully implemented by EEA – main provisions adopted by Switzerland

-

Enforcement Directive – 2014

(Nearly) fully implemented by EEA – not adopted by Switzerland (yet)

-

Amendment Directive – 2018

To be implemented by EEA on 30 July 2020 – not adopted by Switzerland (yet)

-

Directive 96/71/EC – Why and How?

-

- Increase in postings due to establishment of internal market – freedom to provide services

- Fair competition and protection of rights of workers

- Clarity on working conditions

Definition of Posted Worker

Definition of core working conditions, including:

-

-

-

-

-

-

- Minimum rate of pay

- Maximum work periods and minimum rest periods

- Minimum paid annual holidays

- Health and safety regulations

- Protective measures for certain groups

-

-

-

-

-

Directive 2014/67/EU – Why and How?

-

- Abuse and circumvention of applicable rules, e.g. by use of letterbox companies

- Lack of visibility postings for authorities

- Lack of knowledge on applicable working conditions for companies

- Restrictions on allowed administrative formalities

Definition of genuine posting

National website on applicable working conditions

Cooperation between Member States

Definition of allowed monitoring requirements:

-

-

-

-

-

-

- Posted Worker Notification (PWN)

- Record keeping

- Liaison and local representative

-

-

-

-

-

Directive (EU) 2018/957

Reasons for Revision of Directive 96/71/EC

-

- Address unfair practices (social dumping) more effectively:

Wage difference within the Single Market has grown, creating unwanted incentives to exploit these by use of posted workers

- Address unfair practices (social dumping) more effectively:

-

- Ensure level-playing field between companies – functioning of the Single Market:

Requirement to comply with minimum rates of pay only not sufficient to overcome wage difference between posted and local workers

- Ensure level-playing field between companies – functioning of the Single Market:

-

- Update to create better coherence with more recent EU legislation

Key Changes

-

- Host Member State’s rules on remuneration apply (equal pay)

- Host Member State‘s rules on worker‘s accommodation and allowances or reimbursement of expenses apply

- Host Member State‘s mandatory terms and conditions of employment to apply after 12/18 months (long-term posting)

Remuneration & Allowances

-

- Host Member State’s rules apply (equal pay)

- Universally applicable collective bargaining agreements (limited sector scope possible)

- All remuneration components to be considered, e.g.

– Overtime pay

– Special allowances/supplemental payments (mobility, dangerous or hard work allowance; nighttime allowance)

– (Performance) premiums

– As applicable for a comparable worker of the host Member State (personal scope) - Overall remuneration paid must not be lower

- Travel, board and lodging expenditures cannot be included (expenditures ≠ remuneration)

- Temporary Employment Agency Workers

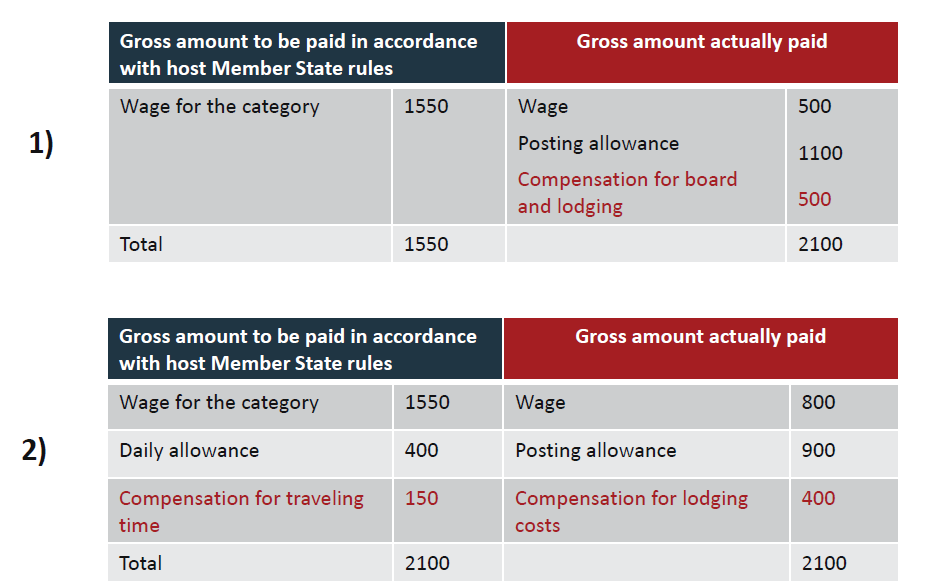

Remuneration & Allowances Examples

Terms and Conditions of Employment

- Host Member State‘s mandatory terms and conditions of employment to apply after12/18 months (long-term posting).

- What are these “mandatory terms and conditions”?

– E.g. regulations re: employee’s sickness, special time-off regulations, other (cash/non-cash) benefits

Not to include:

– Procedures and conditions of conclusion and termination of employment

– Supplementary company pension schemes - 12 months to be extended to 18 months upon “motivated notification” by employer

- “Continuation rule” in case of replacement

- Temporary Employment Agency Workers

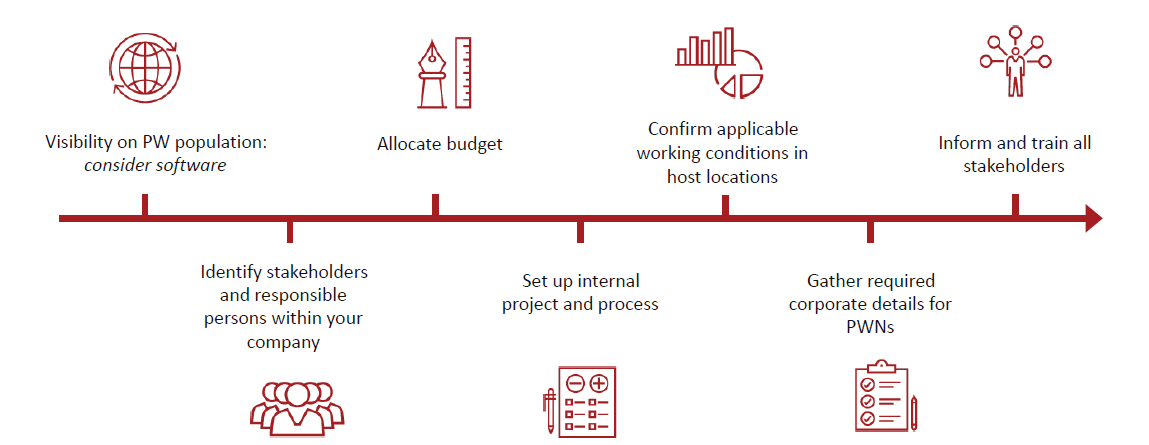

Next Steps Towards Compliance

Q & A

1)

Are the Posted Worker Directives applicable to business trips, i.e., business meetings, seminars etc?

No, employees who do not provide services while sent abroad do not generally fall into scope of the Posted Worker (PW) Directives. Note, however, that some countries do apply a limit to the amount of days someone can attend meetings before they consider it a working activity and subject to the PW requirements. In addition, as an exception, Ireland currently considers any work-related visit to Ireland (including genuine business meetings) to fall into scope.

2)

What if we’re only sending someone for a week or two? Short term postings – how to handle the effort/risk dynamic?

Possibility for exemptions but be careful

3)

If we temporarily assign someone on a host basis, but they maintain home employment ties, do we need to make a Posted Worker Notification (PWN)?

Yes, if they are on home contract (and meet other conditions).

4)

Is an employee on Van der Elst visa holding a work permit for one of the Schengen countries working on a Van der Elst visa in another Schengen country treated as a posted worker?

Usually, yes (if on home contract in the first Schengen country and then posted to the second one)

5)

If someone goes to his home country and works from home for two weeks, for example, is there a Posted Worker Directive requirement?

If there is no service being delivered to any person or any company in the host country, then the person is not a Posted Worker under these Directives. However, we would advise to check on any social security requirements (in certain circumstances an A1 may be required).

6)

Is an employee considered to be a Posted Worker where they are working remotely in a country which is not their home employment country but is not on assignment or working for the benefit of the local entity?

The employee’s regular place of working is a deciding factor. If the employee is assigned to work in a country other than the one where they normally work, and is providing a service for a person or entity in the host country, they will be considered a posted worker.

7)

Are we responsible for notifications of non-permanent employees such as temporary contractors who are hired through an agency, or is the agency responsible?

A genuine self-employed contractor is not an employee and as such not subject to the Posted Worker Directives. It should be noted that some countries do apply some or all of the requirements also to self-employed workers based on their national legislation – in those cases the self-employed worker is responsible for filing the Posted Worker Notification. In some cases, authorities may consider a self-employed person who is carrying out services in their country not on their own behalf but on your behalf to be, in practical terms, your employee. In this case, you may be considered responsible for filing the Posted Worker Notification. This should be assessed on a case-by-case basis.

8)

Who can act as a liaison in the host country if we do not have a presence (no offices) in that country?

This varies by host country, however, in many countries this can be someone at the client (usually not preferred), one of the posted workers, or often a third party can also act as liaison.

9)

For the remuneration/equal pay requirement, is it correct that expenditures cannot be included, but can they be paid as an allowance via payroll and be counted?

Any expenditures for travel, board and lodging can be paid as an allowance via payroll, however, they cannot be counted to meet the remuneration threshold.

10)

If a country allows accommodation to be included as remuneration for the work permit application, can that be included for Posted Worker calculation?

No. Any expenditures for travel, board and lodging cannot be counted as part of remuneration. It should be noted that the work permit requirements are based on immigration law, while the Posted Worker requirements are based on labor law. Requirements are not always the same under both types of laws.

11)

Is there a special timeframe in which a posted worker needs to be in the host country to have equal pay? What if someone only works there for two days, and not, for example, three months?

Generally, there’s no special timeframe. However, Member States may establish rules (or allow those in a collective bargaining agreement) to exempt short-term postings (no more than on month) or postings where only „non-significant“ work is performed from the equal pay requirement. In practice such exemptions are the exception, not the rule.

12)

How do I know if a collective bargaining agreement applies?

Member States are supposed to entertain a “single official national website” where comprehensive information on universally applicable collective bargaining agreements can be obtained.

13)

Is the benchmark salary in the host location a market rate (e.g., labor market testing level of equivalence), or a legal minimum wage (i.e., not relevant for most professional jobs)?

It is the minimum remuneration as determined by law or universally applicable bargaining agreement. This may vary by position and/or experience.

14)

What exactly is meant by posting allowance?

Any allowance specifically paid to the employee during and due to their posting. Depending on the specifics of the case, some, all or none of the allowance can be counted towards the remuneration threshold: this must be looked at for each case.

15)

Do we have to compare our posted employee with a specific group of workers in the host country with the same number of years of experience and job duties?

The remuneration level to be met for Posted Workers is defined by law/collective bargaining agreements. This may vary by position and/or experience.

16)

For the remuneration/equal pay requirement, is it correct that expenditures cannot be included, but can they be paid as an allowance via payroll and be counted?

Any expenditures for travel, board and lodging can be paid as an allowance via payroll, however, they cannot be counted to meet the remuneration threshold.

17)

Do the 12 months need to be consecutive? What about someone carrying out short projects over two years?

The Directive does not specify this. Based on its wording, an argument can be made that it only applies in terms of consecutive periods. However, this will not provide effective protection as intended by the Directive. Looking at the replacement rule, there will be cases where interruptions in between posting terms will have to be disregarded with respect to the 12-month period. Also, look out for national law clarifications in the host Member State.

18)

For long-term postings do the mandatory regulations apply to expats who are already being paid from the host payroll, or does it only affect those that have remained on home payroll?

A posted worker in the meaning of the Directive is somebody who is sent to work for a limited period in another country while remaining in an employment relationship with its employer making the posting. Whether somebody is paid from a company’s payroll does not necessarily mean that an employment relationship exists with this company, so this should be examined for the specific situation.

19)

If Posted Worker Directives don’t apply to business travelers, are there scenarios where there is a Posted Worker Notification requirement but not an immigration requirement?

Yes – often! The terminology may be confusing here – someone who is considered a business traveler within your organization may still be a Posted Worker based on the activities carried out. EU nationals being posted within the EU often don’t need work permits but do need Posted Worker Notifications – there is extra risk when the posting is for up to 90 days (which typically removes the need to make a residence registration application but does not remove the need to submit a Posted Worker Notification).

20)

Would a Posted Worker Notification be required for an employee who is not on a formal assignment but is working from home for a limited period of time for the benefit of the home entity?

Generally, a posting requires a willful and targeted decision to send somebody to provide services to a customer on behalf of their employer. If there is no recipient of a service, then Ppsted Worker Notification is generally not required. A notable exception is Belgium – the Limosa declaration is not only applicable to Posted Workers and is also in most cases applicable to people working from home for the sole benefit of an employer abroad, even if for short periods.

21)

Is there a ‚cooling off‘ period? For example, if we post someone for 12 months and this person works in their home country for another few months – can we post this person again?

The Directive does not specify this. Looking at the replacement rule, a new posting (and hence, a new 12-month period to start) can at least be assumed if the employee will not be doing the same tasks at the same place. If the same tasks will be performed at the same place, then the authorities may consider this a continuation of the posting. We would advise a case-specific assessment to be made.

22)

For employees on home-based assignment packages, FX rate changes could impact whether the salary meets the host levels. Do firms have to assess this each year, each time the salary changes? What if the host level increases?

It is fair to assume that the FX rate will need to be checked/adjusted every time the salary is due for payment (mostly on a monthly basis).

23)

We have been dealing with posted workers from non-EU countries with Intra-Company Transfer (ICT) work permits for up to three years and sending notifications for them. What happens now if they hold such permits exceeding 18 months?

The Directive is not directly applicable to postings from outside of the EU+. It will therefore depend on the national implementation of the Directive (whether or not this also makes it applicable to postings from outside of EU+) if any additional working conditions need to be applied and/or if a motivated notification will need to be filed. This should be checked on a country by country basis. Note as well that based on immigration law additional requirements may apply, e.g. with respect to remuneration.

24)

If a non-EU national who travels on a work permit and starts working on an assignment in the same EU country where they hold a work permit, are they considered a posted worker?

The employee’s regular place of working is a deciding factor. If the employee is assigned to work in a country other than the one where he/she normally works, and is providing a service for a person or entity in the host country, he/she will be considered a posted worker. Therefore, if the person will stay on home country contract and only if the host country is also applying the requirements to postings from outside of the EU+ based on national legislation, then the person will be considered a posted worker (and the Posted Worker Notification will be needed as well as the work permit).

25)

Is there a minimum period of time to be considered as being posted? Or are the activities to be performed leading (e.g. whether or not providing services)?

Generally, there is no minimum requirement (or relevant exemption, except for the initial installation/assembly of goods delivered) and the activities performed will be leading. However, Member States may establish rules (or allow those in a collective bargaining agreement) to exempt short-term postings (no more than on month) or postings where only „non-significant“ work is performed from the equal pay requirement.

26)

How do we manage commuter assignments where they regularly spend three days per week in host country and two in home country – can we apply a blanket Posted Worker Notification?

This varies by country.

27)

Some EU countries have state salary indexation as a matter of course. They also have a 13th month salary and holiday pay built into contracts which do not apply in other EU locations. If sending a posted worker to a country that has these contractual benefits as standard, do we have to provide these to the posted worker as we do to locals?

If these elements are mandated either by law or universally applicable bargaining agreements, then when checking what the total remuneration level is that needs to be met, these items need to be considered. This does not mean that the Posted Worker also needs to receive e.g. a 13th month. It only means that when taking all parts of remuneration the Posted Worker receives, this total remuneration must match the total of the equivalent local worker, which will include their 13th month.

28)

Does the Posted Worker Directive rule apply to independent contractors hired by the company to work in the EU?

A genuine self-employed contractor is not an employee and as such not subject to Posted Worker Directive. This said:

-

- if the contractor is sent to another member state to fulfill a contract on another company’s behalf, under certain conditions the host country authorities may consider them as employees anyway and may therefore still apply the Posted Worker requirements to them.

- if the self-employed person provides services to a client of their own in the EU, in some countries the Posted Worker Notification (PWN) does need to be filed, based on national legislation (e.g., the PWN, also called Limosa Declaration, in Belgium).

29)

How are commuters affected? Their assignment duration might be two years; however, they may work three days/months in the host country.

The Directive does not specify this. Look out for the specific host Member State’s rules, especially exemptions that may be granted in terms of duration. Yet, in case of doubt a day-based consideration may be required.

30)

What are the penalties for failing to observe Posted Worker Notifications?

This varies by country – ranging from between a few hundred Euros to the potential of tens of thousands of Euros per infraction.

31)

If an employee has a Posted Worker Directive registration in the respective country, but they don’t travel every month, do we need to apply equal pay even for those months, during which they weren’t in the host country?

If the employee is not performing services in the host country, there is no posting and hence no requirement to apply the equal pay principle.

32)

Do you notice increased controls on A1 due to the sanitary crisis caused by COVID-19?

The A1 has been requested in order to be allowed to enter certain countries as an essential worker during the lockdown (e.g. France). In general, you can expect to have more on-site inspections due to the additional COVID-19-related health and safety regulations, also at white collar companies. During such inspections the A1 is one of the common documents requested to be shown.

33)

Is it correct that postings to Germany do not require Posted Worker Notifications for white collar workers?

Germany applies a sector specific approach – the Posted Worker Notification is only standard required for postings within certain specific industries, based on the Minimum Wage Act and the Posted Worker Act. The current industries in scope indeed are blue collar industries. However, the list of industries is subject to change. Also, based on the Temporary Employment Act, Posted Worker Notifications are also required for people employed by temporary employment agencies, regardless of the industry they will work in, as well as in certain cases of labor leasing by other types of companies. Therefore, under certain circumstances white collar workers are also subject to the requirement.

Picture: Courtesy by Pixabay/Geralt

Seite drucken

Seite drucken